How does everyone else afford to do all these fun activities and buy all this cool stuff? Some days it can feel like you’re left out of the secret. There isn’t necessarily a secret, but there is a method to the madness. You can start living the life of your dreams through smart money habits. Take small steps to make it feel less overwhelming.

It’s possible to be #adulting and still have extra money for things you want. Here are 10 easy money tips to get you started.

1. Set your money goals

This is simple, ask yourself, “What do I want money for?” It can be anything from living on your own, saving for a dream vacation, or paying down student debt. Whatever your money goals are, write them down. If you are a visual person, you can even make a mood board. This will be the map to achieving your money dreams and you just have to stay on track. Most importantly, keep your goals in mind, because they’ll keep you motivated when things get hard.

2. Keep yourself in check

Go to the store, pick up your favorite wine and chocolates. Next, pour a glass of wine and check your money situation. Understand your wealth (how much money you have) and your income (how much you make). Write down how much money you have in your wallet, bank accounts, and your income. This is a great start, now take the next step.

3. Separate needs vs. wants

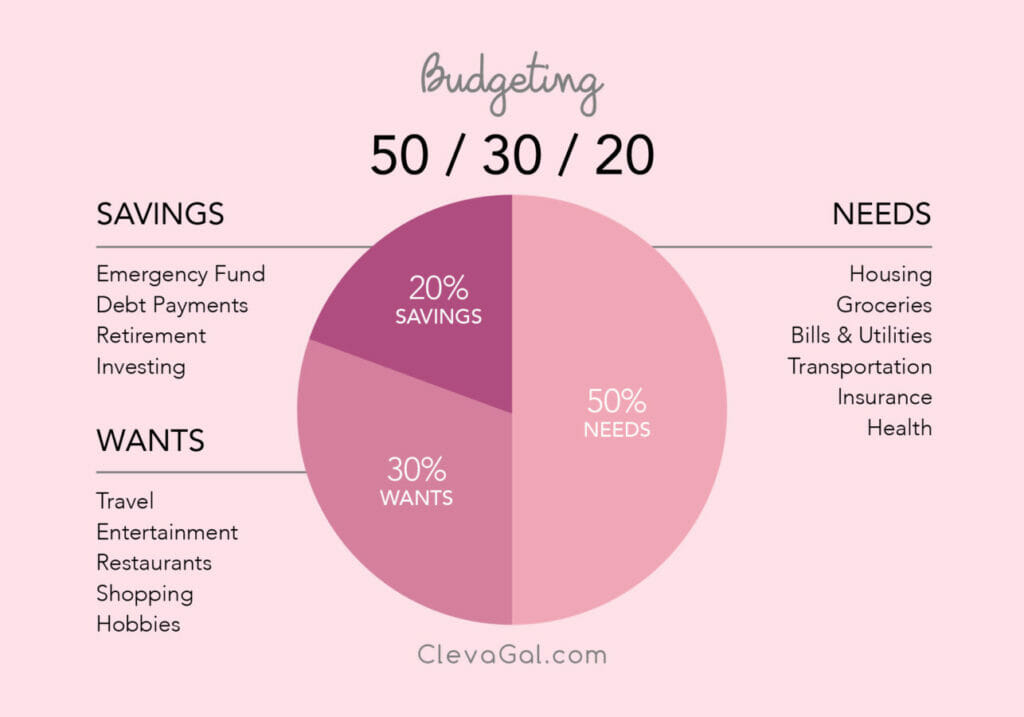

It’s easy to confuse what we want as a need. For example, sometimes my shoe addiction takes over my logic, and that’s when I’m in trouble. If you struggle with needs vs. wants like me, try this practice. Take a piece of paper, and make 2 columns. At the top, label one “needs,” and label the other “wants.” Categorize and write down anything you spend money on under one of the columns, things like rent, car insurance, clothes, lattes, and so on. No cheating though, you aren’t allowed to put anything in both columns. By the end of it, all of your expenses should be neatly separated. We’ll take more about budgeting later with the 50/30/20 rule.

4. Create a budget

If someone asked you how much you spend in a month, would you know? That’s okay if you don’t, only ~30% of Americans budget. Unfortunately, if you have big money dreams like a new phone, vacation, or car, it’s important to budget. You have to find extra money somewhere. To do that, you’ll need a budget. Simply put, a budget is a plan for where your money will go. Let’s break it down. You’ll need to know how much you make, how much you spend, and what you spend it on.

For your next practice, keep track of where your money goes. You can do it the old school way by keeping your receipts or checking your bank statements. Alternatively, if you are techy, I recommend phone apps to help you (more info in step 10).

Next, track at least one month of spending. If that’s too overwhelming, start with one week. The goal is to cover your “needs” expenses while having some for “wants,” and then a little extra for money dream goals. Try to stay consistent and honest with yourself, that’s the only way you’ll achieve your dreams. A simple tip to follow is the 50/30/20 rule. Apply this to your after-tax income, 50% on needs, 30% on wants, and 20% to savings.

5. Find your problem

By now, you should be able to identify what your problem is. Ask yourself which do you struggle with most? You need to decide if one (or more) is keeping you from your goals.

| Money Problems | Solutions |

| Making too little money | – Higher paying job – Work more hours – Start a side hustle – learn to invest |

| Saving too little money | – Follow a budget plan – Automate your savings – Cancel unused subscriptions – Get an accountability pal |

| Spending too much money | – Reduce wants temporarily – Find cheaper alternatives – Freeze or cut credit cards – Use phone apps to alert you |

Regardless of which you struggle with, solving your problem will get you one step closer to your money goals. And remember, when in doubt, 50/30/20 rule out.

6. Face your debt

Hooray! You’ve made it halfway, which means you’re serious about breaking old habits and becoming a money management goddess. Unfortunately, that also means you’re ready for the not so fun part.

Did you know most Americans (~80%) are in debt? Do you struggle with credit card debt, student loan debt, or medical debt? Take a look at your debt reality. You’ve already made it this far, you’ve got this. Future you will thank you. Read about the two ways to pay off debt here under number one.

7. Create a safety net

A great metaphor of a money safety net is a trapeze net. When a trapeze acrobat’s sweaty hands slip while flying in mid-air, the safety net below catches them before they get hurt. Thus, a money safety net is similar so you don’t get hurt when you fall on hard times.

You may be wondering, “How much do I need to save for my safety net?” Remember the budgeting exercise? It depends on your expenses each month. If you are single, you’ll need enough money to cover 6 months of expenses for your safety net. If you are in a reliable relationship, you’ll need enough for 3-4 months of expenses for your safety net. One of the benefits of being in a relationship is that if you fall, your partner can catch you before the safety net. If you’re single, you’ve got to catch yourself.

8. Look at your credit report

Why are credit reports important? Because they’re like your credit card in high school, if you have bad grades, you don’t get into the colleges you want. If you have a bad credit score, you don’t get the credit cards, loans, cars, and houses you want.

Review your credit report like your parents use to scrutinize your high school report card. Similar to figuring out which subject you suck in most, you want to look for which part of your credit report you suck in the most. Failed in gym class? Probably should show up. Failed in credit history? Should probably build some cred. Checking your credit is easier than you think. Did you know it’s free? You get 3 free credit reports a year. Yes, it’s free so you have no excuses not to. For more information on credit reports and how to get them, read here.

9. Save for the future

Save money for the future in case the time machine is invented, so you’ll have money in the future. (Just kidding.) That probably will never happen, so save for your future self in a different way, for when you are old. Nobody wants to talk about getting old, but the future you needs money also. You should save because the future you needs a vacation. Put aside 10 – 15% of your income towards retirement.

And yes, start as young a possible. Whether your 20, 25, 30, it pays off to start early because of compound interest. If you don’t know what compound interest is, watch this video below.

10. Get help

Last but not least – ask for help. Where can you find help? Luckily, we live in the 21st century. There are amazing tools and apps that can help you for free. Yes, for free! If you want some awesome free money apps, you can read more here. Plus, there are many online resources you can google if you have questions. Whatever you do, don’t be afraid to ask for help.

Are you old school and prefer asking people? Financial planners are typically free at many banks and credit unions. All you need to do is call and set up a time, sit down, and chat with them. It’s not as scary as you think. You’d be surprised to find that most people want to help you. And if you like the comfort of your own home, read more about money here.

Congrats! You’ve just taken 10 steps to achieve your money dreams. Don’t stop here, this is just the start. Keep going on your money journey.